unrealized capital gains tax reddit

Find out what happens in the. Taxing unrealized gains reddit.

The L Word A Practical Guide To Deducting Cryptocurrency Losses

An unrealised capital gains tax is a tax applied to the increase in the value of an asset during the relevant period ie.

. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million. It is a profitable position that has yet to be sold in return for cash such as a.

An unrealized gain is a profit that exists on paper resulting from an investment. What are unrealized gains. Deltas from op on january 1st shares of the progenity corporation were 6 dollars a share.

The Problems With an Unrealized Capital Gains Tax. A realized capital gain occurs when an assets price is higher than you bought it for and you sell the asset. If an assets price has increased and you havent sold it yet you have an.

You have 100 asset it goes up in value to 200 it goes back down to 100 you have to pax taxes for that. Gains that are on paper only are called unrealized gains For example if you bought a share for 10 and its now worth 12 you have an unrealized gain. The presidents new budget plan calls on Congress to tax wealthy Americans unrealized capital gains.

It is labelled unrealised because it is not a tax on. Ive been seeing the simplified math posts on here. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

Will the United States implement an unrealized gains tax on cryptocurrency. I am confused how can taxes on unrealized gains. Ira Stoll 3282022 350 PM Share on Facebook Share on Twitter.

If youre holding stocks or other assets the act of selling them for a profit or at a loss results in gains and losses. Currently the tax code stipulates that unrealized capital gains arent taxable income. What this means is that someone who owns stock or property that increases in value.

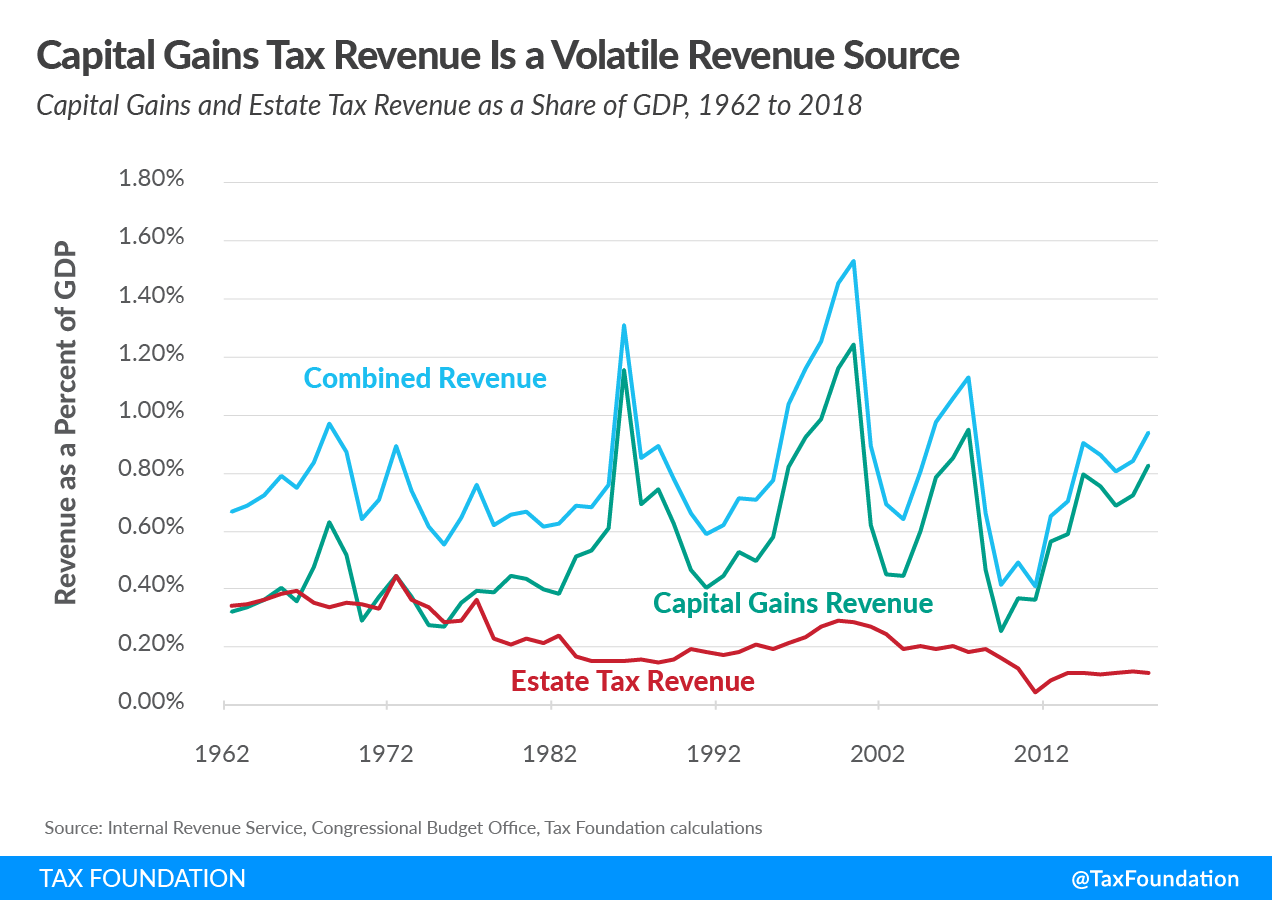

Unrealized Capital Gains Tax. Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. In 2022 the Biden Administration proposed a 20 tax on unrealized gains for all assets including.

Eli5 What Is An Unrealized Capital Gains Tax R Explainlikeimfive

Fact Check Posts Get Facts Wrong On Capital Gains Tax Proposal

How To Pay Less Capital Gains Tax

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Vanguard Target Retirement Funds Surprise 10 Year End Nav Drop And Capital Gains Distribution Explained My Money Blog

Cmv Unrealized Capital Gains Should Not Be Taxed R Changemyview

How Is The Unrealized Capital Gains Tax Supposed To Work R Neoliberal

A Tax On Unrealized Capital Gains Would Have Unprecedented Destructive Potential Learn Liberty

How To Invest In Opportunity Zones And Avoid Capital Gains Stessa

Capital Gains Taxes How To Minimize Them And Why You Might Not Be Able To R Personalfinance

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

Vanguard Target Retirement Funds Surprise 10 Year End Nav Drop And Capital Gains Distribution Explained My Money Blog

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Eli5 Why Is An Unrealised Gains Tax So Bad R Neoliberal

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

Funding Our Nation S Priorities Reforming The Tax Code S Advantageous Treatment Of The Wealthy

How Is The Unrealized Capital Gains Tax Supposed To Work R Neoliberal